Maintaining profit margins is crucial for all

retailers. In this article you’ll

learn:

-

Price Margin Basics: Learn the

fundamental concepts behind calculating sale price

margins to ensure your pricing strategy aligns with

your business goals.

-

Margin Optimization: Discover tips

and strategies to maximize your profit margins

without compromising product quality or customer

satisfaction.

-

Tools and Formulas: We’ve

included useful tools and formulas to simplify the

margin calculation process and help you make

data-driven decisions for your business.

As a retailer, whether you operate a brick-and-mortar

store or an e-commerce empire (or both), you wear many

hats in the pursuit of business success. From managing

marketing campaigns to supporting your employees, or

seeking new, appealing products – you’re

the driving force behind it all.

When you’re curating your product selection,

it’s all about the delicate balance between

price and profit, closely aligned with consumer

trends. You understand that staying on top of the

latest trends drives sales, but you also realize that

it’s your top-selling items that create loyal

customer relationships, with

20% of your products typically accounting for 80%

of your sales.

As a

savvy buyer, you know it’s not just about selecting

popular products; it’s about curating a

merchandise mix

that thrives year-round. Your product assortment

becomes an intricate matrix, especially when you

consider holidays and personal celebration dates. To

ensure sustained profitability, it’s crucial to

identify products that offer not just high retail

markups but also larger-than-average profit

margins.”

Finding Profitability in Your Product Pricing

As a retailer, your margins and markups are where your

livelihood comes from. In 2020, it’s important to

align your buying and inventory decisions to your

store’s overall sales goals. Ask yourself the

following question:

How much do I want to make this year? What are my

profit goals for our store?

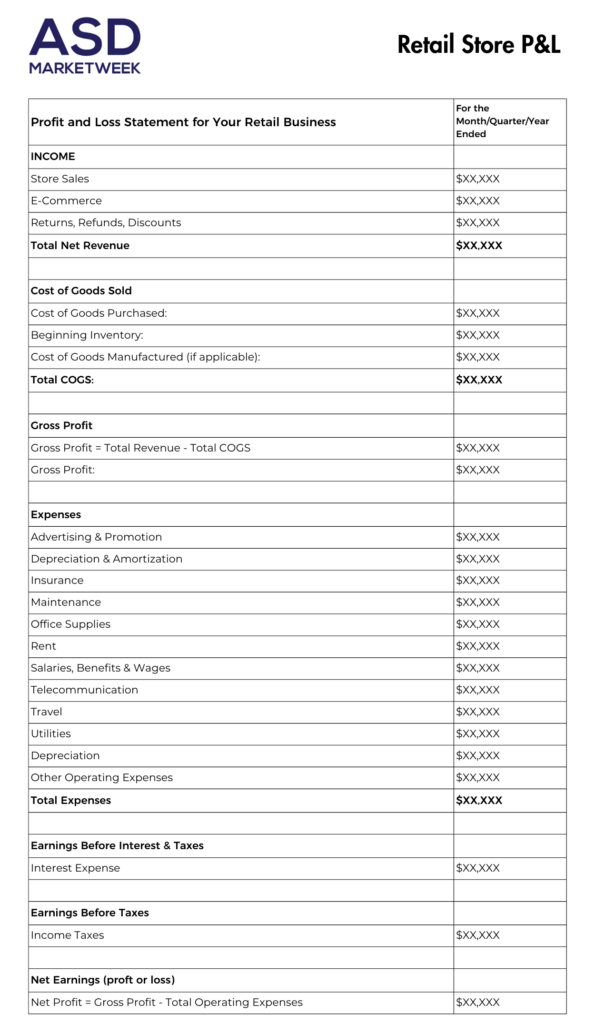

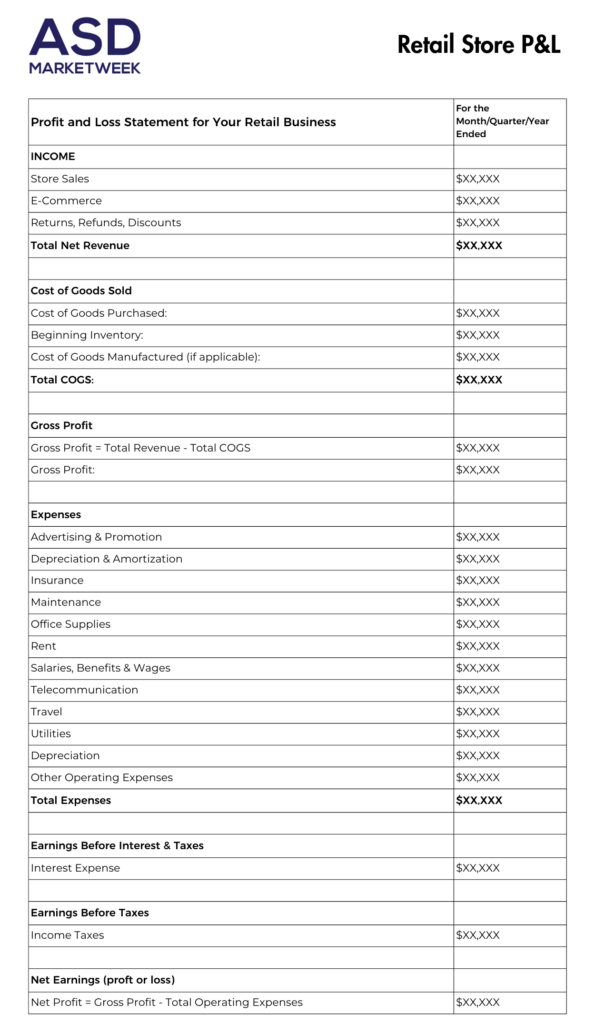

Here’s a free

profit and loss sheet

to help you establish your goal if you need to look at

all your costs. Once you set this number, look at your

inventory. How have you priced the products in your

store or online? Do you know how they are helping or

hurting your goals? Your inventory is your profit

center.You are most likely going to have:

-

Low-profit goods: Items that bring people in

stores and/or items people buy in volume.

-

Medium-profit goods: Items that sell for a

slightly higher margin, sell consistently, but they

don’t sell at the volume of other items.

-

High-profit goods: Items that sell at good

margins or high markups but their sales may be

seasonal or trend-based.

Within low, medium and high-profit margin goods, the

sales patterns can vary depending on many factors.

Sometimes your high margin goods could be consistent

sellers (one item that you pay $5 for and always sells

for $45). Sometimes lower profit goods sell so

regularly that they bring people into your store to

make other one-time purchases and you see a sales

bump.

Because of the factors surrounding sales and traffic,

you must track your inventory and sales data

accurately so that you can easily understand how to

sell more based on what’s moving in your store or what

your customers are buying online. The only way to

strategically price your merchandise is by knowing how

to use margins and markup to your advantage.

Retail Pricing Terminology

Before we talk about margins and markups, it’s

important that you understand several terms. These

terms have a huge impact on your calculations:

-

Price/Revenue: The selling price of goods to

your customers and how much you make from those

goods.

-

Cost/Cost of Goods Sold (COGS): The total

price to produce the item. This includes the

expenses that go into making your products and

providing your services. Calculating COGS also

includes materials and direct labor costs.

-

Gross Profit: The profit left over after you

pay the expenses of selling your products.

Now that we’ve covered these, let’s move onto better

understanding margins and markups.

What Are Retail Margins?

Calculating product margins are based on the wholesale

price you pay for your inventory and the retail price

you charge your customers for that merchandise. Many

retailers believe that a strong margin is double the

cost of an item – so if you purchase something for $5,

selling it for $10 means you doubled your money!

Other retailers aim to gain higher margins to help

them make more money and cover their costs while

increasing their profit. That same $5 item could be

retailed for $15, $25 or even $50 based on a variety

of factors. When calculating margins, you need to

factor in your gross profit and the costs associated

with making the sale (your overhead expenses).

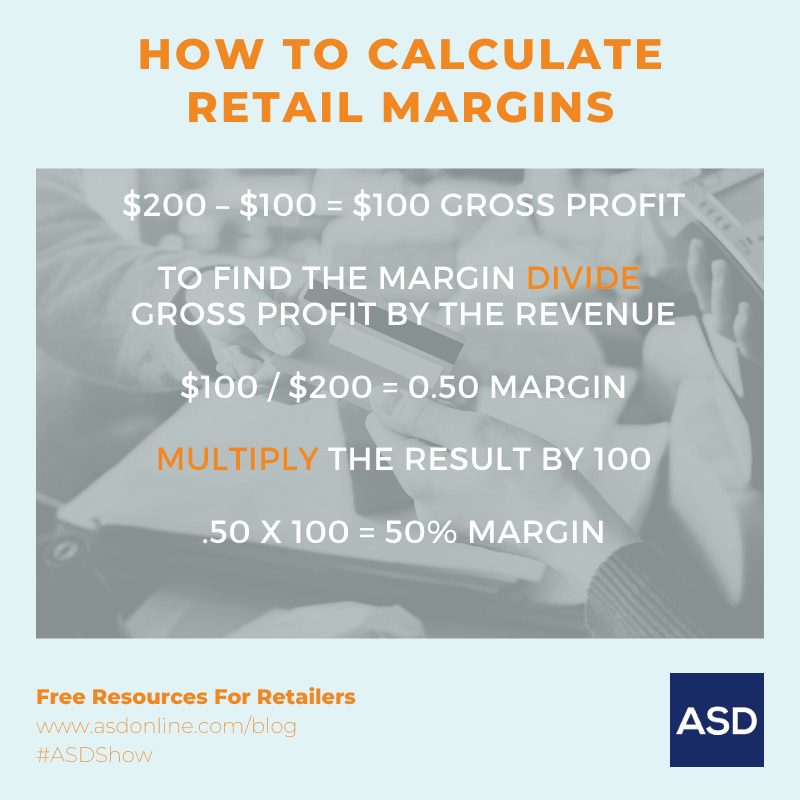

Let’s create an example. You sell a self-care kit for

$200. Each self-care kit costs you $100 to purchase at

wholesale. First, find your gross profit, or the

difference between the revenue ($200) and the cost

($100).

The margin is 50 percent. That means you keep 50

percent of your total revenue. You spent the other 50

percent of your revenue on buying the self-care kit.

Margin measures how much of every dollar in sales, you

keep after paying expenses. The higher your margin,

the more money you make.

The larger the retail margin, the greater the profit

you can make on each sale. However, if you set your

prices too high to increase your margins, other

competitors can set prices lower and steal your

customers. What retail margin doesn’t consider is the

cost associated with making a sale. Taxes, overhead,

and marketing are all paid by your profits so take

that into account as you price items.

What Are Retail Markups?

Markups are different than margins. A markup shows the

percentage of profit, meaning it shows how much more

you make from the selling price less than the amount

the item costs you. Like a margin, you start finding a

markup with your gross profit (revenue minus

COGS). Let’s use the same example of a self-care kit

but we change the price: you sell each kit for $175.

The self-care kit costs you $100. First, find the

gross profit.

The markup is 75 percent. That means you sold the kit

for 75 percent more than the amount you paid for it.

The higher the markup, the more revenue you’re

making.

When Should You Use Margin and/or Markup?

Margin and markup are closely related. Understanding

how to use both will always help you with becoming

and remaining profitable. When it comes to choosing

which one to use, a retailer uses markup to ensure

they are making money with each customer purchase.

In general, markup is extremely helpful when you’re

first starting because you can use it to set pricing

to cover your operating costs. You use margin once

your business is more established and you’re ready

to start diversifying your pricing strategies to

meet your overall revenue goals (based on those

customer purchase patterns we mentioned at the

beginning of the article).

You Need A Great Accountant and Great Software

To be successful as a retailer in 2024, having great

software and a great accountant is one of the single

best investments you can make for continued growth.

You may find an accountant is more important to your

business than outsourced business functions like

marketing. Look for local accountants that specialize

in retail businesses as they are going to have the

most knowledge about retail taxes and laws.

When it comes to software, most retail point of

purchase (POP) systems come with some built-in

inventory features, but we’ve found many are limited

in helping retailers make sense of their cash flow as

it correlates to their inventory. Shopify is a go-to

for many retailers who sell online, but you also have

many other choices like Square, Clover, and many more.

Mastering your finances as a retailer and

understanding how you price goods is one of the most

important things you can do as your income is what

drives the reinvestment you make in your business.

Make your profitability your top priority!

0 Comments